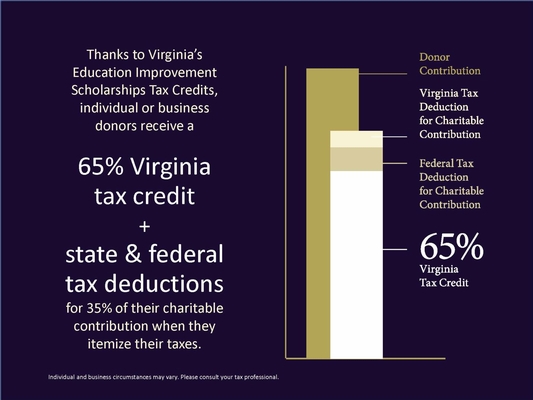

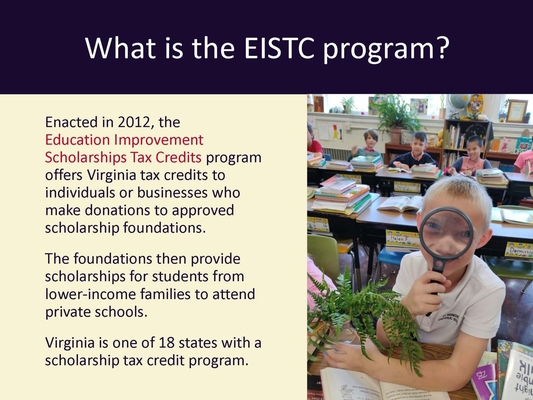

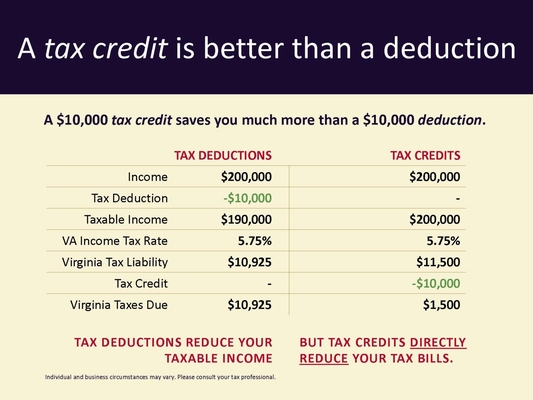

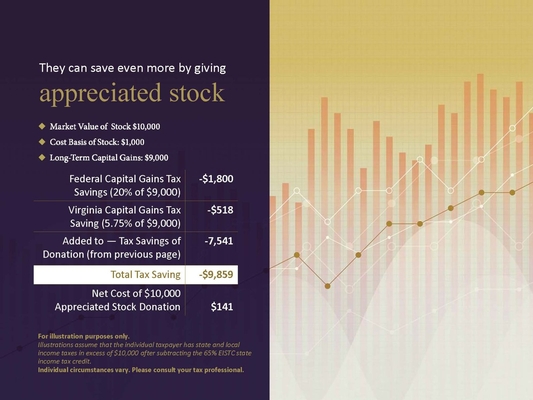

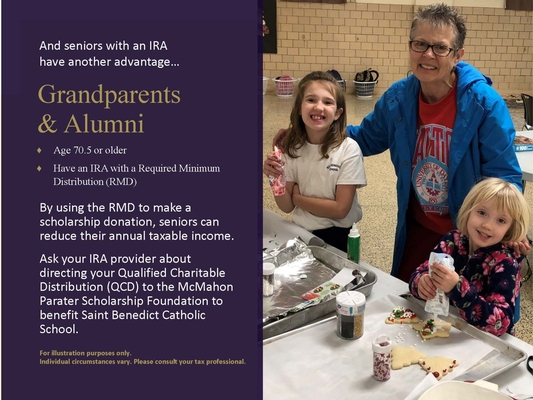

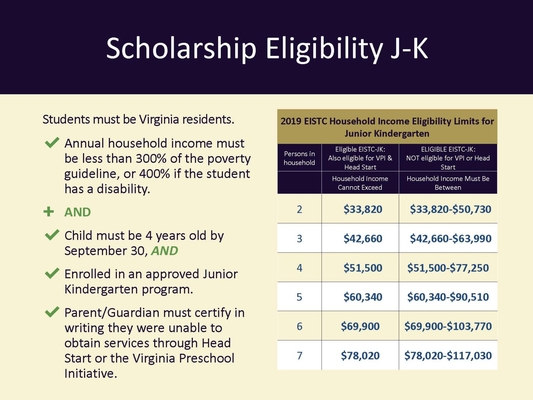

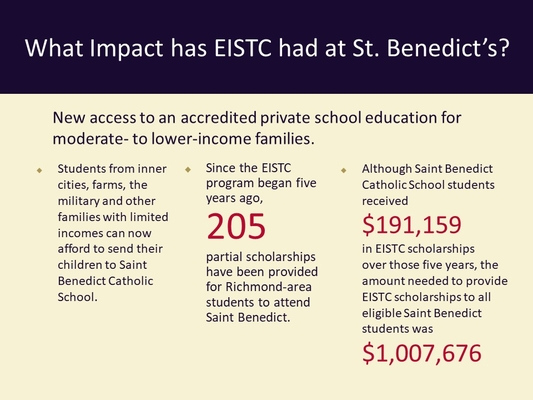

The Virginia Education Improvement Scholarship Tax Credit Program provides funded financial aid to make a Saint Benedict education a manageable sacrifice for families who qualify, while insuring the school has funds necessary to operate. Please take a moment to review the following information on how the EISTC program works and share it with your tax advisor to see how this can reduce your annual tax burden and provide critical scholarship funding for families wanting a St. Benedict education for their children.

- EISTC Fact Sheet

- EISTC Bulletin

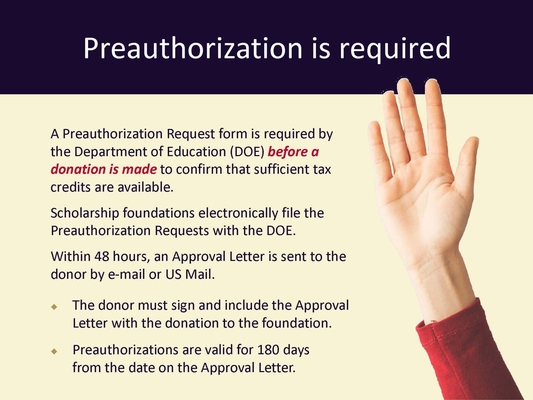

- EISTC Preauthorization Form

- EISTC Letter of Intent (fillable PDF)

- EISTC Letter of Intent (printable)

- EISTC Slide Presentation (above)

For more detailed information visit the McMahon Parater Foundation website or contact Gretchen Ridgely, Director of Admissions & Development, at development@saintbenedictschool.org or 804-254-8850.

Thank you to our 2023 EISTC Donors!

Ruth & Franco Ambrogi

Anonymous

Prof. & Mrs. James R. Baron

Robert & Catherine Bauer

Dr. Michael Bradley

Jeff & Mary-Margaret Buthe

Mr. & Mrs. James P Carreras

Dr. & Mrs. Andrew Chapman

Kevin & Mariah Crawford

Mr. & Mrs. George B. Daugherty (Nojo Inc.)

Christopher & Teresa Dodson

Francis & Ngoc-My Guidarelli

Christopher G Kulp

Mark & Samantha Mikkelson

Mr. & Mrs. Stephen G. Reardon

Mr. & Mrs. Dana Roussy